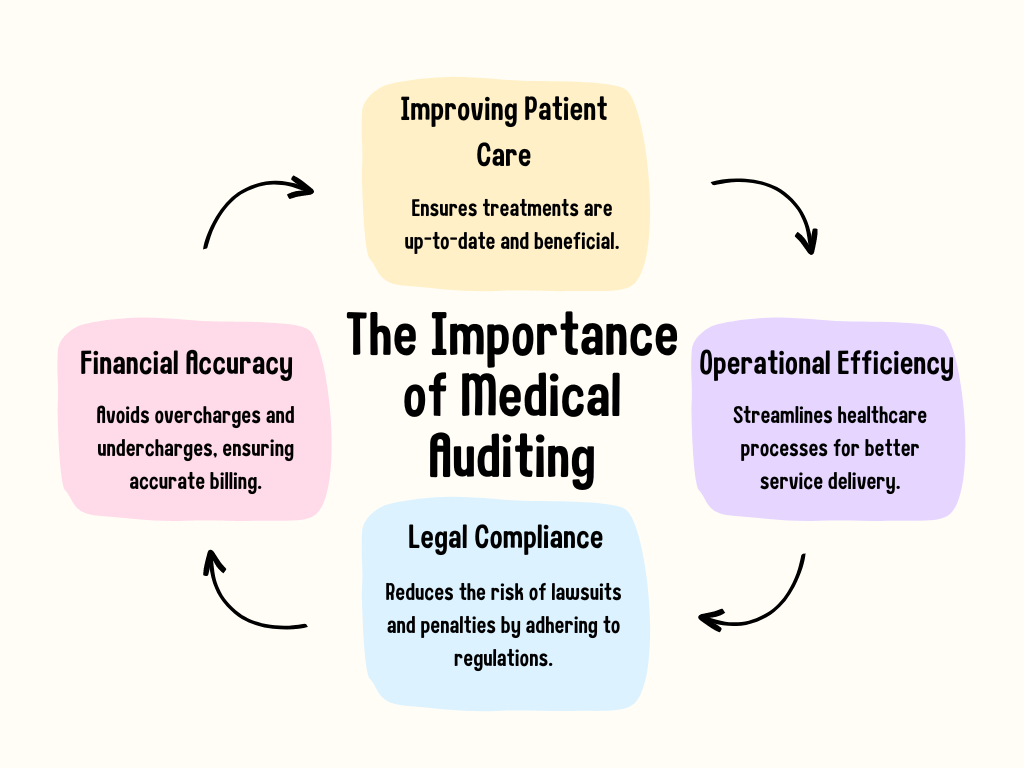

A medical audit is a systematic examination of medical records, billing records, and other relevant information in order to ensure accuracy, compliance, and the best possible care for patients. This medical audit also does double duty to protect the hospital from liability and fraud or abuse. There are different types of medical audits and they can be performed in-house or by a third party, even some medical billing companies can perform a medical audit. Here’s everything you need to know about medical auditing.

Types of Medical Audits

Medical audits examine a variety of aspects of healthcare services. Audits can be classified into several categories based on their focus, nature, and objectives. Audits address specific areas of concern or cover a wide array of services as many factors overlap. Different types of medical audits help you get a better view of your entire practice. Medical audits can be done internally; however, many providers choose an external audit by a third party, so the results won’t be biased.

Clinical Audits:

Definition: Clinical audits assess the quality and outcomes of clinical care with established guidelines and standards. Essentially, are you hitting the goals and expectations for care that would provide a pleasant experience?

Purpose: To identify areas of excellence and areas for improvement in patient care.

Process:

Reviewing patient records.

Comparing actual patient outcomes against expected outcomes based on established guidelines.

Offering feedback to healthcare providers.

Benefits: Clinical audits improve patient outcomes, reduce complications, and improve adherence to medical guidelines by identifying gaps in care.

Coding and Billing Audits:

Definition: Audits that check medical billing and coding accuracy.

Purpose: Protect healthcare providers from fraudulent billing practices and ensure proper reimbursement.

Process:

Examine a sample of patient data and associated expenses.

Examine the services supplied and the rates billed for irregularities.

Recognizing under coding, over coding, and lost billing possibilities.

Benefits: Accurate billing audits can reduce the risk of legal issues and ensure financial transparency.

Compliance Audits:

Definition: Compliance audits verify whether or not healthcare practices are in accordance with regional, national, or international regulations and legislation.

Purpose: To protect against potential legal ramifications and to provide the highest levels of patient care.

Process:

Evaluating policies, methods, and practices in light of regulatory requirements.

Interviewing employees to assess their knowledge and grasp of compliance measures.

Examining papers for proof of conformity.

Benefits: Ensuring compliance not only minimizes legal risks but also boosts the reputation and credibility of the healthcare establishment.

Operational Audits:

Definition: This sort of audit evaluates the effectiveness and efficiency of healthcare operations.

Purpose: To improve service delivery by streamlining operations, reducing waste, and reducing waste.

Process:

Reviewing regular operations and workflows.

Actual practices are being compared to best practices.

Identifying bottlenecks, inefficiencies, or possible opportunities for improvement.

Benefits: Operational audits can result in faster service delivery, lower costs, and a more positive patient experience.

Financial Audits:

Definition: In a hospital setting, this entails a thorough examination of financial statements, transactions, and related systems.

Purpose: To ensure financial accuracy, integrity, and transparency.

Process:

Examining financial statements, ledgers, and transaction records for accuracy.

Verifying financial data for accuracy.

Examining the data for any contradictions or irregularities.

Benefits: Financial audits create stakeholder confidence, ensure fiscal accountability, and prevent financial fraud.

The Medical Auditing Process

Regardless of the type, medical auditing follows a structured process. In this way, consistency, objectivity, and comprehensiveness are ensured. During the medical auditing process, each of the four primary stages-Preparation, Examination, Reporting, and Implementation-plays a crucial role in ensuring that actionable insights are gained from the audit. Even when working with third-party auditors, they will still follow some outline with key objectives.

Preparation:

One of the most important steps to ensuring success in the medical audit is preparation. During prep, you’ll want to handle some specific tasks. Mainly:

- Objective setting for the audit

- Data collection

- Team selection (whether that’s in-house or using an external party)

- Determination of boundaries of audit

- Establish a timeframe for the audit

Examination

Now is the time to focus on the data you have collected. While each examination process looks different depending on the auditor, there is some key process that usually takes place:

- Thorough data review

- Observing in-person practice

- Benchmarking results against best practices or industry standards

Reporting

After a thorough examination of the data, results will then be collected and filed into a report. The reports should outline how the result matches the stated objectives that were outlined in preparation. This process may look like:

- Drafting preliminary findings

- Discussions with stakeholders

- Finalizing and reviewing the report

- Presenting the report to staff and stakeholders

Implementation

The last part of an audit is to make a change! That may look like:

- Crafting an action plan

- Monitoring the new action plan to match goals

- Receive feedback from staff and stakeholders

The Top 10 USA Medical Billing Companies for Medical Practice

Learn MoreChallenges in Medical Auditing

While medical auditing is essential for consistent high-quality healthcare, it is not without difficulties and problems. These difficulties might differ depending on the type of audit being performed, the individual healthcare facility, or even the regulatory environment of the region or country.

Evolving Healthcare Regulations and Laws

Medical legislation and laws are always changing. Keeping up with these developments takes not just time but also knowledge. It is a constant necessity to update staff and educate them on policy changes.

Resistance to Change within Healthcare Settings

The whole point of an audit it pinpoint problems and improve your medical office. However, Audits may cause established organizations to oppose changes, especially if they include considerable operational changes or resources. Given their knowledge, medical professionals may be cautious to accept suggestions from auditors, especially if they believe it interferes with their autonomy or judgment.

Resource Limitations

In an ideal situation, you’d most likely want an external objective third party to conduct the medical audit. However, many facilities may short-change services like that or reduce the scope of the audit. It can be difficult to perform an audit when healthcare facilities reduce resources or reduce available data or access to staff.

Need a Medical Billing Company to Help with an Audit?

Are you looking for a medical billing company that can help you with auditing and pinpointing problems? 360Connect can help you! We help customers find medical billing companies every day. Just fill out our 1–2-minute forms and we’ll connect with you to figure out your needs. From there, you’ll receive up to 5 quotes from qualified suppliers.