Automotive fleet leasing companies are popular options for logistic and transportation companies. There are a wide variety of fleet lease options to choose from such as sedans, suburban’s, carrier vans, trucks, and even semi-trucks. Automotive fleet leasing companies can provide businesses with flexibility and options. However, there are some downsides to renting a fleet just as there are to buying. You’ll need clearly defined business goals to make the partnership work.

What is Fleet Leasing?

Automotive fleet leasing is exactly as it sounds. A company leases vehicles from another company for a certain period of time. These vehicles are then used to complete necessary company operations. Automotive fleet leasing companies usually offer a wide range of vehicles to choose from as well as financing options. Term and pricing are laid out in a specific contract. Once the lease is complete, the company will then return the vehicle to its original owner. There are two main types of lease agreements automotive fleet leasing companies use:

Open-ended (TRAC) Lease

Open-ended leases usually last about a year. After that, the contract goes month-to-month if the Lessee (person who holds the lease) still needs the vehicle. The company gets to keep the vehicles, and this can be a great fix for temporary fleets or those who want flexibility. However, maintenance costs may not be included in this lease during the 12-month period or after. Pricing can also fluctuate once the lease becomes month-to-month.

Open-ended leases typical are also known as terminal rent adjustment clause leases (or TRAC Lease). This means that when an automotive fleet leasing company leases a vehicle, a resale value is determined based on the condition and mileage of the vehicle. Once the vehicle is given back to the automotive company, they will resale the vehicle. Once the vehicle is sold, the lessee may owe money based on the difference of that initial value.

The process goes as follow:

- A lessor (person who leases) leases a fleet of vehicles for a defined period to a company.

- The value for the vehicle is determined at the present time as well as in the future based on mileage and conditions.

- The lessee uses the vehicles per the agreement.

- They finish use of the vehicle and return them to the company.

- The lessor then resales those vehicles.

- If the price is lower than the original stated value, the lessee pays the difference of the value to the lessor. If the selling price is higher than the original amount, the lessor reimburses the lessee the difference.

This type of agreement puts the responsibility on the lessee to make sure the vehicle stays within mileage and condition requirements. If not, they’ll end up owing more money.

Close-ended Lease

Close-ended agreements do not provide as much flexibility but are more stable in pricing. They are usually longer leases, around 3 years, and have set pricing for those three years. Once the lease is up then a company has to return those cars. Sometimes maintenance costs will be covered by the automotive fleet leasing company, other times it won’t be. Companies like this option because they aren’t on the hook if the vehicle depreciates more than what is stated in the contract. Furthermore, it’s a fixed price that won’t fluctuate.

Essentially, as long as you stay within the mileage and conditions requirements, you can walk away. It’s fairly simple and easy to do. These leases tend to be higher as leasing companies may end up with a vehicle that does not have as high of a resale value.

Vendor fees are also a factor to consider when choosing an automotive fleet leasing company. Common fees could include:

- Acquisition fees

- Delivery fees

- Administrative fees

- Interest fees

- Maintenance management program fees

- Accident fees

- Registration fees

- Vendor-specific service fees (vendor may provide a specific service for a fee)

Pros and Cons of Automotive Fleet Leasing Companies

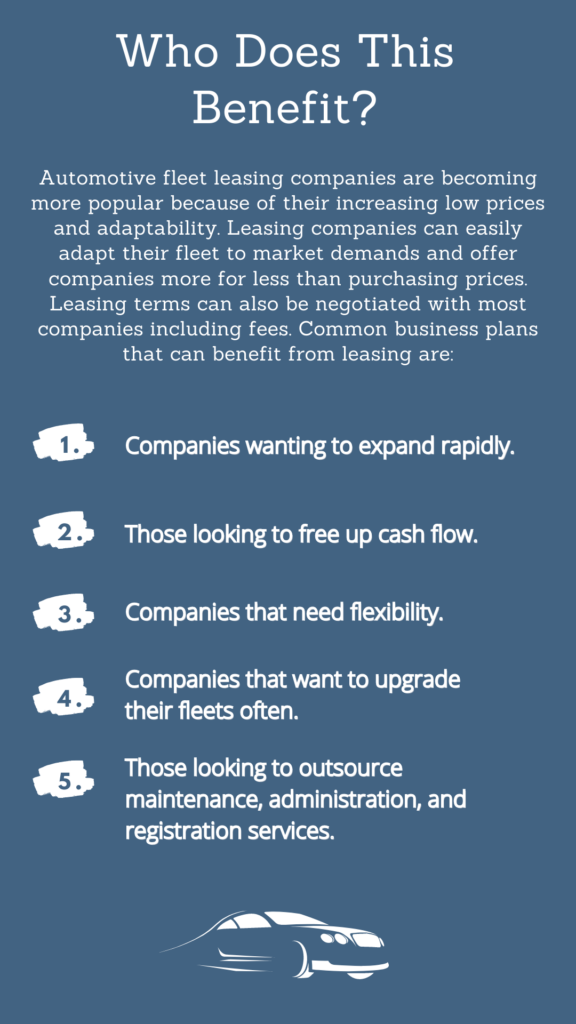

Automotive fleet leasing companies aren’t the right choice for everyone, but they can be strategic choices for companies that are just starting out or have very little capital. In terms of managing assets, leasing is also becoming a valuable tool eliminating the cost of a depreciating asset. Before making any decision, define the future of your company and your goals. How will those goals specifically match up with fleet leasing? Even simple questions such as “do the vehicles come with dashcams?” can make a big difference in price and options. Not to mention, are you implementing best fleet practices for your management system.

Pros:

Cheaper than buying outright (expanding the fleet)

If you have limited capital to invest in a fleet, it can be in your best interest to lease. Instead of purchasing upfront, you can manage payment over a period of time. This can free up extra cash flow and keep your starting costs lower. Leasing vehicles can also be a great way to scale your business quickly. For smaller companies, it may be more advantageous to not worry about investing in maintenance crews and equipment and instead invest in proper fleet tracking.

Flexible leasing options

Leasing often provides businesses flexibility when it comes to managing capital as well as securing vehicles for a specific period of time. With TRAC options, you can keep a vehicle as long as you need it and then return the vehicle. Again, there are secured options like a closed-ended agreement which can give you more stable pricing for a longer fixed term. This can help businesses get their fleets in order without breaking the break. More importantly, this makes upgrading a breeze.

Can deduct leasing costs from taxes

One of the most advantageous things about leasing fleets is the ability to deduct lease costs from taxes. This means that you will pay for a business expense pre-tax dollars, which can be more beneficial than spending post-tax dollars. This will, however, prevent you from using the standard mileage rate according to the IRS. Some businesses find deducting lease payments better for their company than just taking the standard mileage rate method for the entire lease period. Before choosing, meet with your financial accountant to make sure that deducting leasing costs is right for you.

Specialized vehicles

Some automotive fleet leasing companies offer specialized vehicles. These vehicles may be outfitted with special equipment or perks. You can select vehicles for specific jobs and lease them rather than owning them. This can be much more cost-effective for businesses just starting out or working on one-off projects.

Reduced costs

Generally speaking, it is going to be cheaper for your businesses to lease than it will be to purchase a fleet of vehicles. Startup companies often lease vehicles first until they have a steady cash flow. Some companies also bundle certain services together such as fleet management software, fleet tracking, insurance costs, administrative tasks, and more. These services could also reduce hours worked as well as cost. Because you don’t own the vehicles your debt-to-income ratio will appear lower on paper. This could be an option if you are looking for investors for your company.

Financing can be done by a lessor

Instead of hassling with a bank over loan options, some of the top automotive fleet leasing companies offer financing options. You’ll work with the leasing company to secure the financing and ongoing rates. Companies may also provide you with special deals or options for financing with them as well.

Cons:

You don’t own the vehicles

You aren’t buying the asset, just renting it. That means you can’t resale this asset or max out its life usage. You’ll have to adhere to strict guidelines concerning milage and conditions. If those conditions aren’t met, you could be reliable for extra fees or have to pay the difference on a TRAC lease.

Add-on charges

Some companies may tack on extra fees or charges when leasing. These fees could be cost-prohibitive to your bottom line, especially if they are ongoing. Make sure to look carefully over your contract

Business conditions can change

The best-laid plans don’t always come to fruition, and that can be true of business dealing as well. While leasing, you will be responsible for the wear and tear as well as the mileage for a vehicle. If your workload isn’t predictable, leasing may be a bad option for you. You could go over your mileage limit, costing you more money in the long run.

No Modifications

Most leasing contracts will stipulate what you can and can’t do to a vehicle. However, some jobs or deliveries may require modifications or special equipment. You may also be stuck with a vehicle that doesn’t fit your specific needs. In this instance, leasing fleets doesn’t provide you with much flexibility before the ending of the lease. You also can’t make any of those payments back like you could with a resale.

Top Companies to Work With

According to Global Fleet, the largest fleet leasing companies in North America to work with are:

What’s Right for You?

If you are looking for the lowest cost when it comes to vehicles and plan on upgrading often, automotive fleet leasing companies are correct for you. You can cut costs and outsource administrative tasks, saving you time and money.

Are ready for leasing? Want to find a provider that truly understands your situation and can help? At 360Connect, we can provide you with quotes from high-quality suppliers based on your needs. Don’t wonder if you could save money, find out now how fleet management can save you money!

Ready for more?

Check out our article on the top 5 fleet management companies!